Running a laundromat business can be a profitable venture, but it also comes with its own set of challenges, one of the most stressful being tax season. As a laundromat owner in 2024, you must become familiar with the current tax laws and regulations that apply to your business, and it's crucial that you file your taxes accurately and on time. It's all too common that laundromat owners struggle with this task, leading to stress and anxiety when tax season rolls around. In fact, a survey by the Small Business Administration found that taxes remain the second most common reason small businesses seek professional help after accounting.

Your laundromat taxes don't have to feel like an insurmountable task. With the right information and guidance for 2024, you can get through tax season without a hitch. In this comprehensive guide, we'll cover the essential steps to take during tax season, provide tips on filing your taxes accurately, and highlight common tax mistakes to watch out for. By following these tips, you can:

-

Align with current tax laws

-

Increase your deductions under 2024 guidelines

-

Minimize your tax liability

-

Learn about the enhanced tax benefits of owning a laundromat in 2024

Navigate tax season with the help of the Cents Complete Laundromat Tax Guide. Discover specialized tax deductions for laundromats and keep more money in your pocket.

1. Organizing your financial records

As a laundromat owner, one of the most important factors during tax season is having accurate and organized financial records. This is crucial not only for tax compliance but also for sound business management practices. By keeping your financial records in order, you can track your revenue and expenses, monitor your cash flow, and make informed business decisions. Use our Laundromat Profit Calculator to find out how much revenue you brought in for the year after expenses.

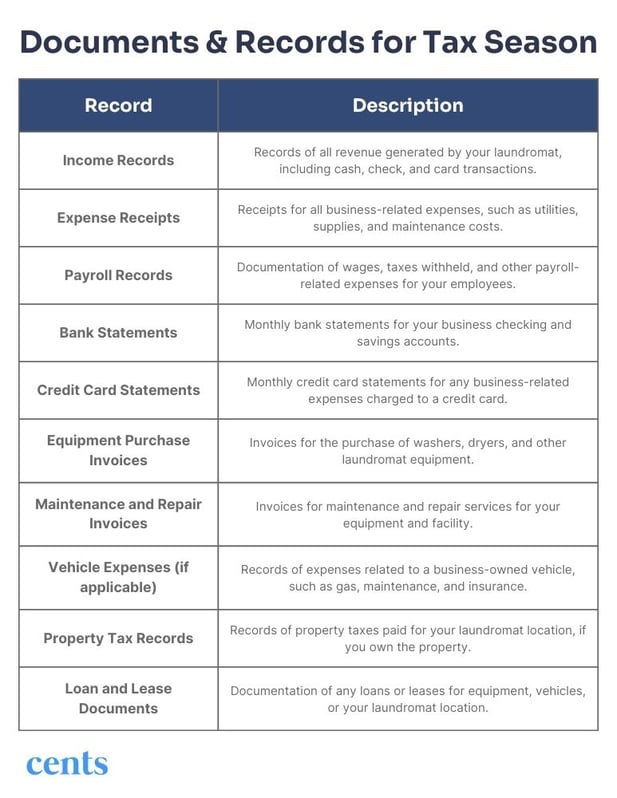

To get started, you should gather all the necessary documents and records for tax season. This may include sales receipts, invoices, bank statements, credit card statements, payroll records, and any other financial documents related to your business. It's important to keep both hard copies and digital copies of these documents, as well as any receipts for deductible expenses.

Once you have all your necessary documents in one place, you can create a system to organize your financial records. This could be as simple as setting up a filing system for physical copies of documents and creating a spreadsheet to track your revenue and expenses. Alternatively, you may want to consider using software, such as Cents, to keep track of your financial records automatically.

Cents is a business management platform designed specifically for laundry businesses. It offers features like expense order tracking, invoicing, and sales tax reporting to help you stay on top of your finances throughout the year. By using Cents, you can save time and effort in organizing your financial records and ensure that your tax return is filed accurately.

Quick Tip:Keeping accurate and organized financial records is essential for laundromat owners during tax season. By gathering all necessary documents, creating a system to organize your financial records, and utilizing tools such as Cents, you can streamline the process and ensure compliance with tax laws. |

2. Understanding tax deductions for your laundromat business

It's important to understand the common tax deductions for laundromats in 2024. These deductions can help you reduce your taxable income and decrease your tax liability, saving you money when it comes time to pay. Consider these updated tax write-offs for laundromat owners:

- Equipment depreciation: For 2024, you can take advantage of 80% bonus depreciation on qualified equipment purchases. Additionally, Section 179 expensing limits have increased to $1,220,000, with a phase-out threshold of $3,050,000. This means you can potentially write off the full cost of new washers, dryers, and coin machines in the year of purchase, subject to these limits.

- Write-offs unique to laundromats: Laundromat owners are eligible for some unique write-offs. In 2024, laundromat owners can benefit from expanded write-offs, including utilities such as water and electricity, as well as maintenance and repairs to your laundry equipment. With rising utility costs, these deductions are particularly valuable this year.

- Self-service laundry tax: As of 2024, 42 states (with Maine being the latest addition) now exempt self-service laundry from sales tax. Only Hawaii, West Virginia, and New Mexico continue to assess sales tax on self-service laundry. Be sure to check your state's current requirements as some states have updated their policies.

Determining which expenses are deductible is a bit tricky. As a rule of thumb, the deductible expense should be both ordinary and necessary for your business. An ordinary expense is one that is common and accepted in your industry, while a necessary expense is one that is helpful and appropriate for your business.

Keeping accurate records of all your business expenses will make it significantly easier to maximize your deductions and avoid overpaying on laundromat taxes. This includes keeping receipts for purchases, tracking your mileage for business-related travel, and documenting any other expenses that may be deductible.

Quick Tip:Understanding which tax deductions are available to your laundromat business can help you reduce your tax liability and save you money. Don’t forget to take advantage of equipment depreciation, unique write-offs, and self-service laundry tax deductions, if applicable. Also, always keep accurate records of your expenses and consult with a tax professional to ensure that you are claiming all eligible deductions for your laundry business. |

3. Completing your tax return

Once you’ve compiled your financial records and understand the range of potential tax deductions available to you, it's time to begin preparing your tax return. Here are the important steps for completing your tax return efficiently and accurately:

-

Determine the type of tax return required: As a laundromat owner, you may need to file different types of tax returns, depending on the structure of your business. For example, if you operate as a sole proprietor, you will file a Schedule C with your personal tax return. On the other hand, if you operate as a partnership or corporation, you will need to file separate business tax returns.

-

Gather the necessary forms and schedules: Depending on the type of tax return you are filing, you may need to gather additional forms and schedules. For instance, if you are filing a Schedule C, you will need to complete Form 1040, too. You’ll likely need to complete additional schedules to report income or deductions.

-

Complete your tax return: Once you’ve gathered all the necessary forms and schedules, you’re in a good position to complete your tax return. This can be a confusing process, especially if you have multiple sources of income or deductions. It's worth it to take it slow and ensure that you’ve entered all your tax return data accurately.

-

Consult a professional tax expert: If you’re not sure how to finish your tax return, you might find it helpful to consult a professional tax expert. A tax professional can help you rest assured that your tax return is filed correctly and can provide valuable advice on how to maximize tax deductions for your laundromat.

-

Review your tax return for accuracy: Before filing your tax return, it's important to double-check the information you entered. Be sure that you’ve recorded all the necessary information correctly and that you have claimed all the deductions you are entitled to. This can help you avoid penalties and sizable fines later on.

Quick Tip:Completing your tax return can be a complex process, especially for laundromat owners. It's important to determine the type of tax return required, gather all the necessary forms and schedules, complete your tax return accurately, and consult with a tax professional if necessary. Finally, review your tax return for accuracy before filing to ensure that you are complying with tax laws. |

4. Working with a tax professional

Working with a tax professional can be a great investment for laundromat owners, especially those with complicated finances. They can help interpret complex tax laws, increase your deductions, and near guarantee that your tax return is filed accurately and on time. Here are some essential things to consider when working with a tax professional.

Benefits of working with a tax professional

A tax professional can provide a range of benefits, including saving you time and reducing your stress during tax season. They can also help you avoid expensive mistakes, uncover potential deductions that are easily overlooked, and give expert advice on how to manage your laundromat taxes throughout the year, making future tax seasons a breeze.

How to choose the right tax professional for your business

When selecting someone to work with, it's important to ask for their experience, qualifications, and reputation. Look for a professional who specializes in completing taxes for laundry businesses and has a proven history of helping clients save money on their taxes.

Tips for working effectively with a tax professional

To get the most out of your relationship with a tax professional, it's important to openly communicate your unique needs. Be ready to provide all the necessary financial records and answer any questions they may have. It's also important to establish clear expectations for timelines, fees, and deliverables.

In addition to working with a tax professional, there are also a number of resources available to help laundromat owners manage their taxes. For example, the IRS offers a range of free resources, including online tax tools, publications, and tax workshops.

Quick Tip:Working with a tax professional can be a valuable investment for laundromat owners. Be sure to choose a professional who has experience working with small businesses and has a strong track record of helping clients save money on their taxes. Additionally, communicate openly and honestly with your tax professional and take advantage of resources such as the IRS to manage your taxes effectively. |

5. Common tax mistakes to avoid

Tax mistakes can be costly for laundromat owners, resulting in penalties, fines, and even audits. Here are some common tax mistakes to avoid:

-

Failing to keep accurate records: Keeping accurate financial records is essential for tax compliance. Failure to do so can result in missing deductions, miscalculating taxes, and even being audited by the IRS.

-

Mixing business and personal finances: It's important to keep your business and personal finances separate. Mixing them can result in confusion, missing deductions, and even legal liability.

-

Not taking advantage of deductions: As we discussed above, there are a number of deductions available to laundromat owners. Failing to take advantage of these deductions can result in paying more taxes than necessary.

-

Filing late or not filing at all: Failing to file your tax return on time can result in penalties and fines. Additionally, failing to file at all can result in even more severe consequences, including legal action.

-

Incorrectly reporting income or deductions: It's critical to accurately report your laundromat income and deductions on your tax return. Failure to do so can result in penalties and fines, as well as an audit by the IRS.

To avoid these common tax mistakes, you should focus your efforts on staying organized and keeping accurate records throughout the year. Consult with a tax professional if you are unsure about how to manage your taxes. Finally, be sure to review your tax return for accuracy before filing to ensure that you are complying with tax laws.

Quick Tip:Avoiding common tax mistakes is essential for laundromat owners to ensure compliance with tax laws and avoid penalties and fines. By staying organized, keeping accurate records, taking advantage of deductions, filing on time, and accurately reporting income and deductions, you can manage your taxes effectively and save money on your tax bill. |

Navigating tax season for laundromat owners in 2024

Tax season for laundromat owners can seem daunting, but with the right preparation and understanding of 2024's specific opportunities and challenges, it can be a manageable and even advantageous process. By organizing your financial records and understanding the enhanced tax deductions available this year - particularly the increased Section 179 limits and current bonus depreciation rates - you can maximize your savings and reduce your tax liability.

Working with a tax professional who understands the latest changes in tax law can provide valuable support and advice throughout the tax season. This is especially important in 2024 as we navigate both permanent tax code features and provisions that will begin to phase out in coming years.

Furthermore, avoiding common tax mistakes such as failing to keep accurate digital records, mixing personal and business finances, not taking advantage of current deductions, filing late or not filing at all, and incorrectly reporting income or deductions can prevent penalties, fines, and audits. By taking proactive steps to avoid these mistakes, you can ensure compliance with tax laws and keep your business running smoothly.

We hope this guide has provided you with valuable information to help you navigate the 2024 tax season with ease!

Navigate tax season with the help of the Cents Complete Laundromat Tax Guide. Discover specialized tax deductions for laundromats and keep more money in your pocket.

.png)

-3.png)