6 Steps to Remote Laundromat Management: Operator's Guide

Learn strategies and utilize tools to oversee your laundromat from anywhere, ensuring efficiency and profitability while enhancing your work-life balance.

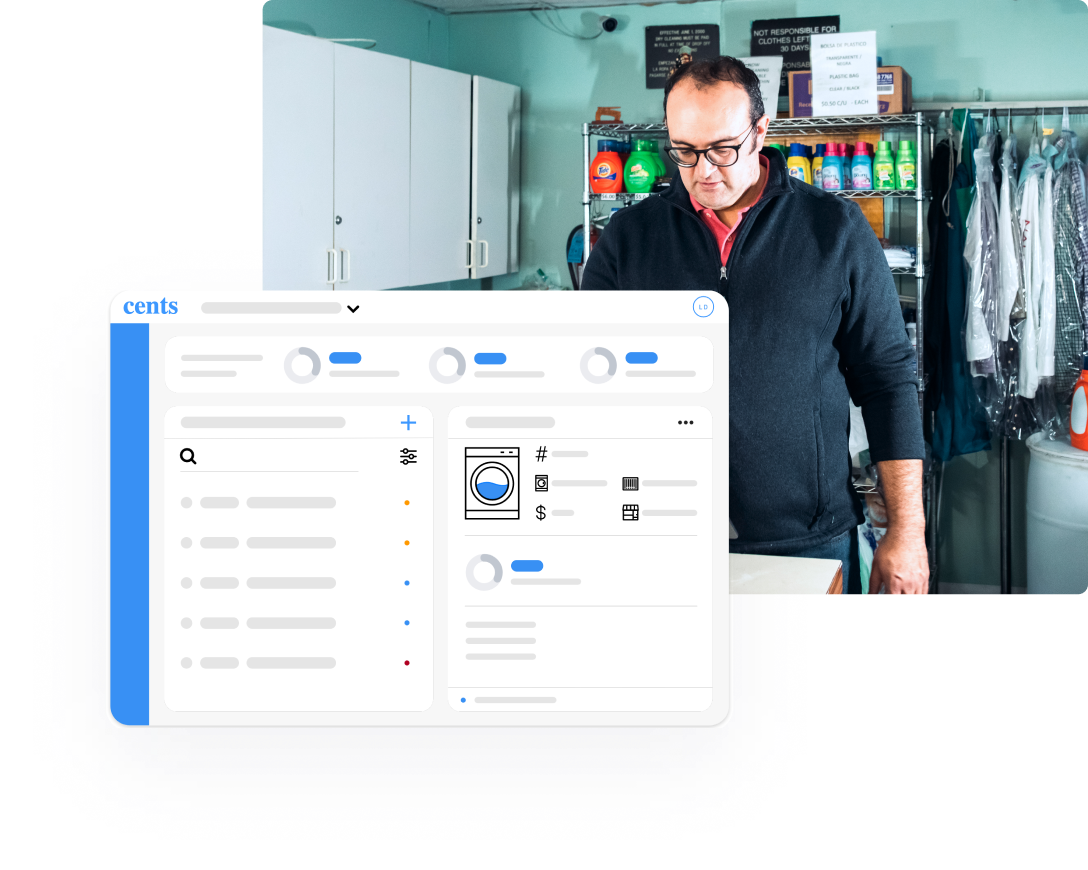

Control your operation

.png)

Power your wash & fold

Built for self-service

Accept orders online

Manage your product sales

Manage your team

Financial management tools

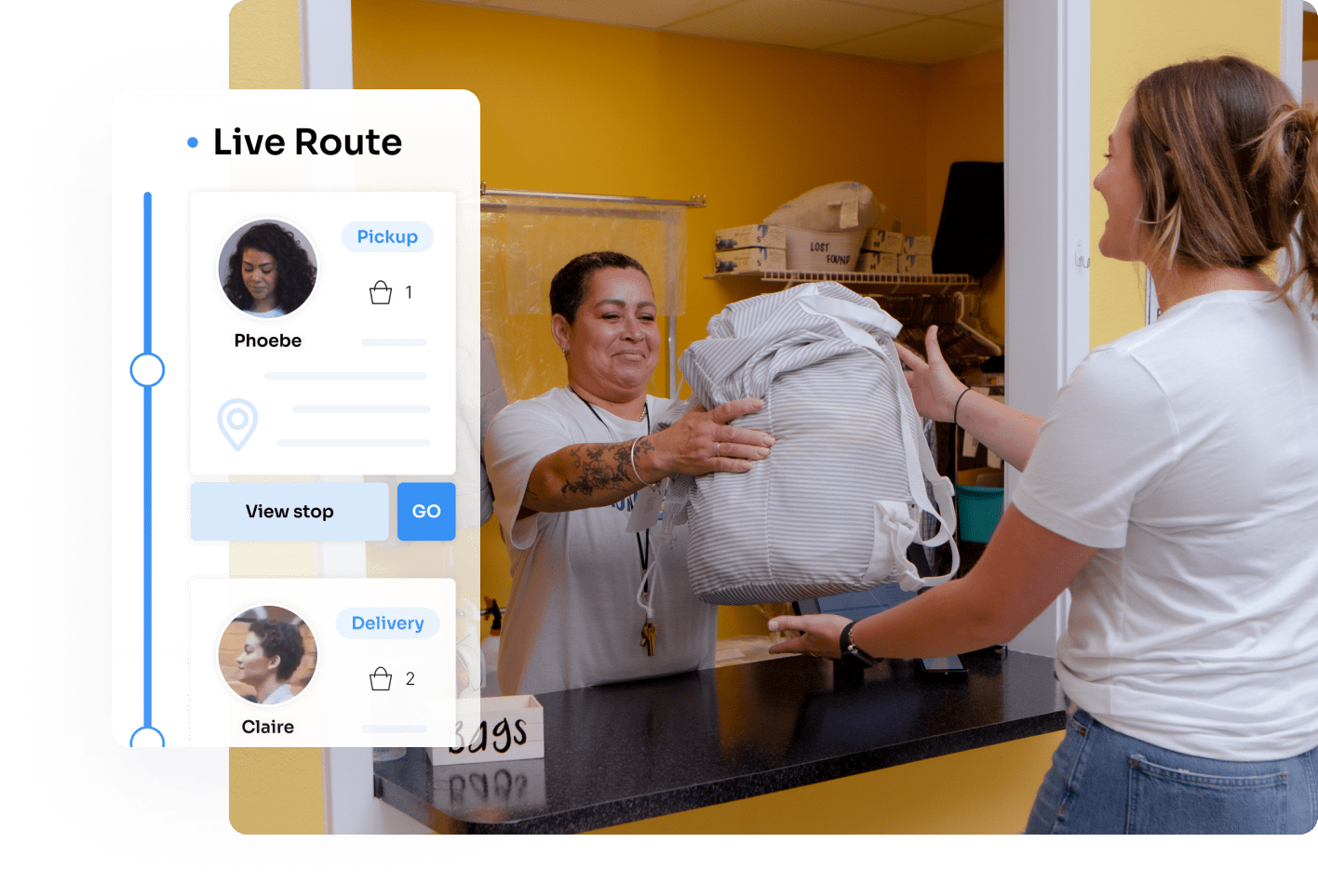

Manage your routes

Elevate your customer service

Send professional invoices

-3.png)

Boost customer loyalty

Get working capital

Navigating tax season can be complex and time-consuming, especially for laundromat owners immersed in day-to-day operations. With significant tax law changes and new digital reporting requirements in 2024, staying informed is more crucial than ever.

This resource shows you how to handle taxes and find tax savings in your laundromat business, whether you're just starting or already operating.

TAX GUIDE FEATURES

Unlock valuable tax deductions through increased Section 179 equipment write-offs, energy efficiency credits, technology modernization, and sanitization equipment write-offs to reduce your tax burden.

Navigate the evolving tax landscape with confidence through expert guidance on digital payment reporting, electronic filing requirements, modern record-keeping, and cloud-based accounting.

Master critical 2024 requirements for digital payment reporting, energy credits, technology expenses, electronic filing, and cloud storage compliance to protect your business.