Running a successful laundromat business hinges on two factors: providing excellent laundry services and managing costs effectively. Whether you’re planning to open a laundromat or improve your current operation, understanding the cost of laundromat ownership and operations is essential.

In this guide, we’ll break down laundromat costs, how to calculate them, and strategies for maintaining profitability. If you’ve ever wondered, “How much does it cost to open a laundromat?” or “What are the ongoing expenses of running one?”—keep reading for actionable insights.

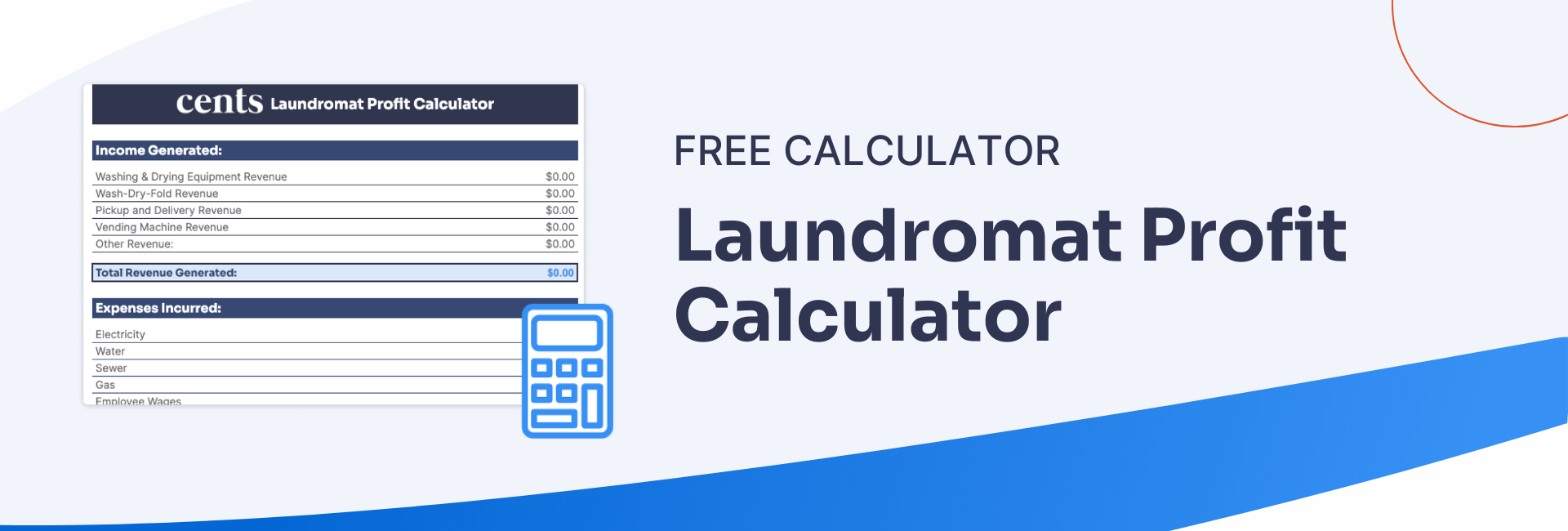

Download our laundromat profit calculator to find out how much profit your laundromat is making each month, quarter, and year.

The cost of opening a laundromat

If you’re a current laundromat owner, what are your biggest challenges related to expenses that would make your life easier if solved? On the flip side, what strategies have you found most effective in maintaining a balance between costs and profitability?

Starting a laundromat involves a significant upfront investment. On average, laundromat startup costs range from depending on factors like location, size, and equipment needs.

Here’s a breakdown of major initial expenses:

-

Equipment: High-efficiency washers and dryers are a significant portion of startup costs.

-

Leasehold improvements: Renovations, plumbing, and electrical work tailored to laundromat needs.

-

Permits and licenses: Local regulations and fees for operating your business.

-

Marketing: Initial advertising to attract customers.

By accurately forecasting these laundromat startup costs, you’ll be better prepared to secure financing and develop a sustainable business plan.

Monthly costs of running a laundromat

Operating a laundromat comes with ongoing expenses that vary based on size, location, and services offered. Typical monthly laundromat costs range between $5,700 and $17,800. Here's a detailed list:

-

Utilities: Water, gas, and electricity are major costs due to equipment usage.

-

Rent or mortgage payments: Your location greatly influences this expense.

-

Maintenance and repairs: Essential for keeping equipment running smoothly.

-

Insurance: Protecting your investment against risks.

-

Labor costs: Staff salaries, if you offer attended services.

-

Supplies: Laundry detergents, vending items, and cleaning supplies.

-

Marketing and advertising: Attracting new customers and retaining existing ones.

-

Taxes: Local, state, and federal taxes.

-

Loan payments: If you’ve financed equipment or renovations.

-

Equipment depreciation: Gradual reduction in equipment value over time.

Step-by-step guide: How to calculate laundromat expenses

%20-%20blog%20blob.png?width=439&height=439&name=BestWash%20(5)%20-%20blog%20blob.png)

Accurately calculating laundromat costs is a fundamental aspect of running a successful laundromat. It aids in financial planning and budgeting as well as helps in identifying areas where costs can be optimized. Here's a step-by-step guide for how to calculate ongoing expenses:

Step 1: Gather financial data about your laundromat

Begin by collecting all financial documents, including bank statements, bills, receipts, and loan documents. Leaving no stone unturned is essential as it forms the basis of an honest expense calculation. Organize these documents in a manner that allows easy access and analysis. Digitizing these documents or using financial software can streamline this process, and protect you from lost documents.

Step 2: Categorize laundromat expenses

Divide your expenses into categories: fixed, variable, and one-time costs. Fixed expenses, also known as recurring expenses, like rent or mortgage and insurance, remain constant regardless of business performance. Variable expenses, such as utilities and supplies, fluctuate based on usage. One-time costs, or laundromat startup expenses, might include equipment purchases or major repairs. Proper categorization helps in better forecasting.

Step 3: Calculate fixed expenses in your laundromat

First, focus on your fixed expenses like rent, insurance premiums, and employee salaries. These costs are typically straightforward to calculate because they don’t change from month to month. Summing up these expenses will give you a clear picture of the minimum amount of revenue your laundromat needs to generate monthly.

Step 4: Calculate variable expenses

Variable expenses require a more nuanced approach. For utilities, track consumption over several months and find the average of these costs, accounting for seasonal variations. Supplies and maintenance costs should be tracked and averaged out over the year for an accurate monthly estimate.

Step 5: Account for depreciation and one-time costs

Equipment depreciation is a significant but easily overlooked portion of laundromat accounting. Calculate this by dividing the cost of the equipment by its expected lifespan. For one-time expenses, record them as they come, making note that these are not regular operational costs but necessary for long-term sustainability.

Step 6: Analyze monthly and annual totals

Last, compile these expenses monthly and annually. This comprehensive view allows you to track financial performance and find patterns or areas where you can save some money. Regular analysis of these totals will help you maintain a profitable laundromat business.

Expense tracking and budgeting

Regularly tracking expenses is crucial for accurate budgeting, identifying cost-saving opportunities, and ensuring overall profitability. With technology and modern tools, a tedious task is made much simpler!

By implementing software solutions for expense tracking, you can monitor costs in real-time, enabling you to make swift, informed financial decisions. These digital tools can automate various aspects of expense management, from utility bill tracking to inventory control, reducing the time and potential errors associated with manual tracking.

Types of technology solutions that automate expense tracking:

-

Cloud-based accounting software

-

Point-of-sale (POS) systems integrated with expense tracking

-

Inventory management software, which optimizes the usage of supplies

Ideally, you should opt for a solution that rolls all three of these into one, holistic system that streamlines your operations, saves you time on tedious (but necessary tasks), and protects your profit margins.

Explore our suite of laundromat management tools designed to save time and boost revenue

How to calculate ROI: Comparative analysis of expenses vs. revenue

Calculating return on investment (ROI) is a critical measure for any laundromat owner, serving as a key indicator of the business's financial health. You can generate all the revenue in the world, but if you’re not taking into account the cost-level it takes, you’re not getting the whole picture. To calculate ROI in the laundromat context, you simply compare your expenses versus revenue.

First, determine the total annual laundromat operating expenses, then calculate the annual revenue generated from laundry services, additional offerings, and any ancillary income. Find the ROI by subtracting the total expenses from the total revenue, dividing this figure by the total expenses, and then multiplying by 100 to get a percentage. This number gives a clear picture of the profitability of your laundromat.

(Total Revenue – Total Expenses) / Total Expenses x 100 = ROI%

For example, if your laundromat generates $200,000 in annual revenue and incurs $120,000 in total expenses, your ROI would be 66.7%. This figure helps you assess whether your pricing, costs, and operations are aligned with your financial goals.

Keep in mind, making a smart laundromat investment, adding new revenue streams through ancillary services, and implementing strategic pricing models create the building blocks for an optimal ROI.

Planning for future laundromat cost

Planning for future expenses allows you to safeguard your laundry business for years to come. Here are key strategies for creating a robust financial plan:

-

Emergency fund: Establish an emergency fund to cover unforeseen costs such as urgent repairs or economic downturns. This fund acts as a financial cushion, preventing the need for unplanned high-interest borrowing.

-

Regular financial reviews: Conduct frequent financial assessments to understand your cash flow and savings capability. This enables timely adjustments in your budgeting and savings plans.

-

Insurance coverage: Ensure adequate insurance coverage for your equipment and business operations. This mitigates financial risks associated with accidents or natural disasters.

-

Investment in maintenance: Regular investment in maintenance can prevent larger expenses down the line. Proactive upkeep reduces the likelihood of major equipment failures.

-

Future expansion planning: If considering expansion, plan financially for this growth. This includes assessing the costs of new equipment, additional locations, and increased staffing needs.

-

Diversification of revenue streams: Explore avenues for additional income, such as offering new services. This not only allows you to boost current revenue but also provides an additional financial buffer.

A well-structured financial plan addressing both immediate and future needs places your laundromat on a path of financial resilience!

Tools to optimize laundromat costs

Managing a laundromat effectively requires not only monitoring expenses but also finding innovative ways to reduce costs and streamline operations. Fortunately, modern tools and technology solutions can simplify expense tracking, improve efficiency, and ultimately protect your bottom line. Here are some essential tools to help you optimize your laundromat costs:

1. Cloud-Based Accounting Software

Automated accounting software helps laundromat owners stay on top of finances with features like expense tracking, revenue monitoring, and profit analysis. These tools can integrate with your bank accounts, categorize expenses, and generate real-time financial reports.

Benefits:

-

Streamlines financial management and reporting.

-

Reduces manual errors in calculations.

-

Provides a clear overview of your cash flow and profit margins.

2. Point-of-Sale (POS) Systems

An integrated POS system tailored for laundromats can track customer transactions, monitor sales trends, and manage payment options, including cash, credit cards, or mobile payments. Some advanced systems also sync with your accounting software to provide seamless financial tracking.

Benefits:

-

Simplifies customer payment processes.

-

Tracks revenue in real time, providing insights into peak hours and services.

-

Reduces the need for manual record-keeping.

3. Inventory Management Tools

Inventory management software is essential for tracking supplies like detergents, vending machine stock, and cleaning products. These tools automate ordering and help you maintain optimal inventory levels, ensuring you never run out of necessary supplies while avoiding overstocking.

Benefits:

-

Prevents stockouts and ensures consistent operations.

-

Avoids over ordering, which ties up cash flow unnecessarily.

-

Provides insights into supply usage trends, helping to forecast future needs.

Take control of your laundromat costs

Successfully managing a laundromat involves a comprehensive understanding all the cost of laundromat ownership. Knowing how to calculate laundromat expenses accurately is vital, as it impacts factors such as cost control, efficient tracking and budgeting, and strategic pricing, all of which are essential in maximizing profitability.

Take the next step in optimizing your laundromat’s profitability by using our Laundromat Profit Calculator. This tool will assist you in making informed financial decisions, helping you to get the most accurate look at your ROI and achieve greater success in your laundromat venture.

Download our laundromat profit calculator to find out how much profit your laundromat is making each month, quarter, and year.

.png)

-3.png)